Introduction: Slippers Are Being Reimagined From “Basic Footwear” to “More Premium Category”

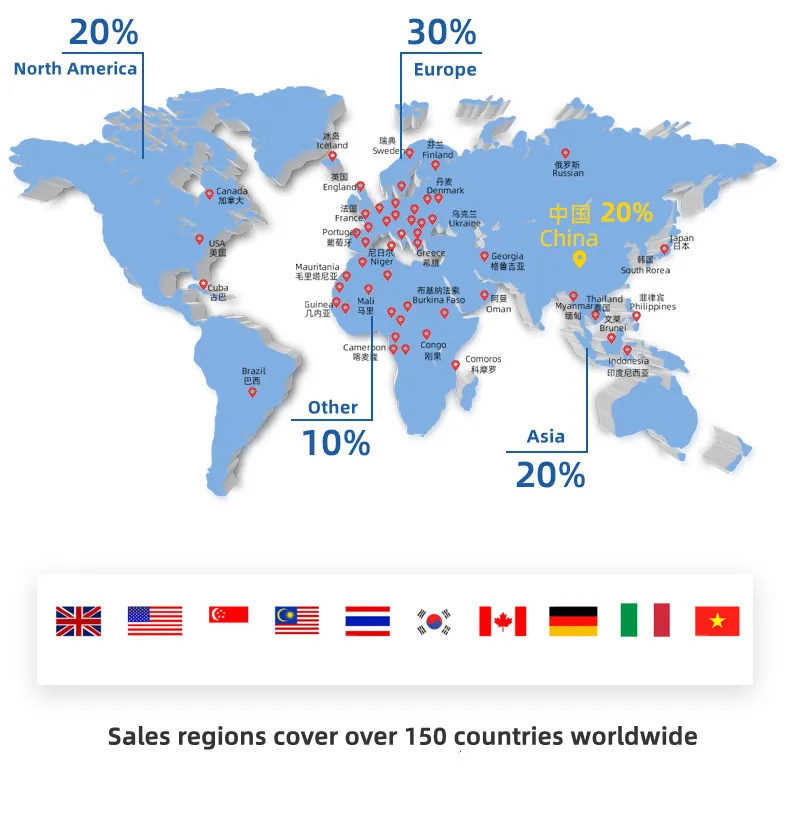

The global sustainable footwear market size was valued at US$12.35 billion in 2025 and is projected to reach US$13.73 billion in 2026, according to the latest market research. Within this growth curve,” slippers, has far exceeded the average level as a subcategory of ”high frequency of use + low decision threshold+strong repurchase attribute”. Slippers take the largest part of the footwear market application, occupying up to 80% of the market in Europe and North America, and these two areas are considered the leading regions in slipper trends.

For your wholesale purposes, slippers are no longer just your “basic products” to round out your SKUs, but a key category that can deliver predictable high-end pricing through functional upgrading, material innovation, and design differentiation. The article on the 3 most important dimensions for slipper wholesale buyers, particularly interested buyers: changes in trends, bestselling product predictions, and purchasing action guidelines in the new year, aiming to give you feasible reference suggestions on choice and stockpile of products.

I. 2026 Slipper Industry Trends and Consumer Preference Insights

1.1 Regional Differences Based on 2025 Sales Data

Reviewing the overall sales data for 2025, significant differences in slipper consumption between the European and American markets are clearly visible.

In the North American market, consumers prefer casual and sporty style slippers. Thick-soled, lightweight, wear-resistant styles with certain outdoor attributes (such as athletic slippers and indoor/outdoor slippers) continue to be bestsellers. Functionality and practicality are the primary decision factors. According to data from the American consumer survey agency Nielsen, over 60% of respondents are willing to pay a premium for high-quality slippers, with antibacterial, anti-slip, and waterproof properties being particularly crucial.

In the European market, consumers’ aesthetics and values tend towards simplicity, environmental friendliness, and design. Classic silhouettes like Birkenstocks and mules continue to maintain stable sales. At the same time, environmental sustainability has upgraded from a “bonus feature” to a “basic requirement.” Research from the Swedish brand H&M Home shows that 78% of European consumers are willing to pay a premium for slippers made with sustainable materials, with an average premium of approximately 18%. This directly drives slipper trends towards upgraded materials and restrained design.

1.2 Defining Colors and Styles: Gen Z is Driving the Trends

Based on extensive sales data and consumer feedback, the trends in slipper colors and styles for 2026 are becoming increasingly clear.

In terms of color, turquoise green, with its inclusive and natural symbolism, will become the dominant color. This blue-green color not only weakens gender boundaries but also conveys the concept of harmonious coexistence between humans and nature, which perfectly aligns with the European and American markets’ recognition of sustainable values.

In terms of style, Gen Z consumers are becoming the core driving force. They are more inclined to choose slipper products that “express themselves,” such as styles with brand logos, custom prints, or modular decorations. In terms of design language, the combination of simple geometric lines and athletic silhouettes is becoming one of the most promising directions in slipper trends. For slipper wholesale buyers, this means that “customization options” themselves are an important selling point.

1.3 Functional Upgrades: Driving Premium Prices with “Perceptible Value”

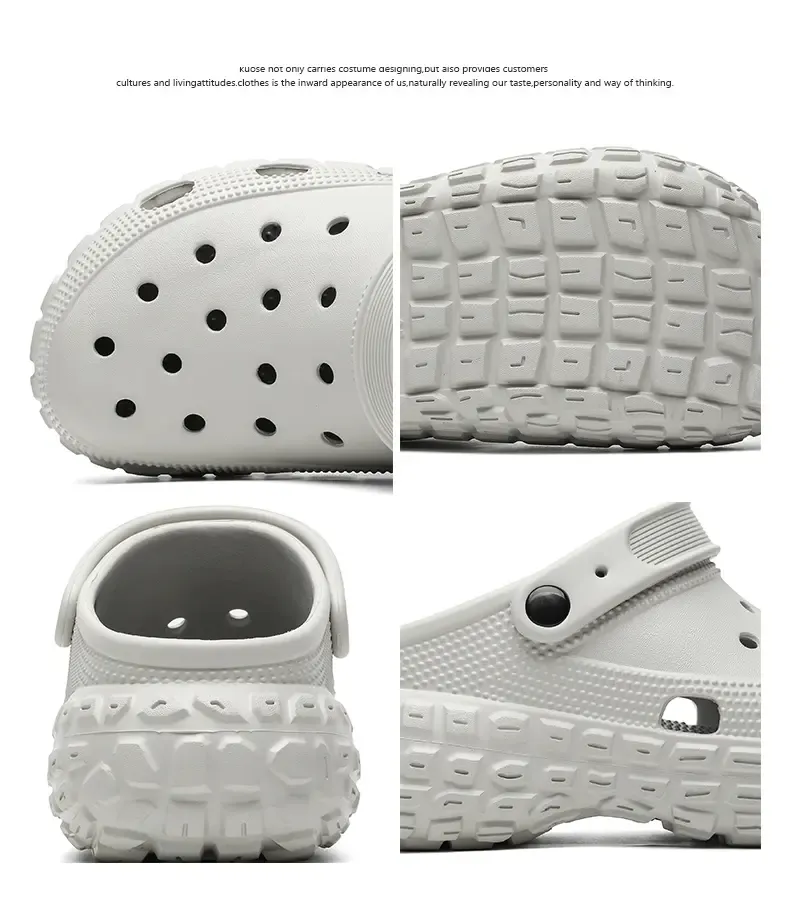

In 2026, slipper functional upgrades will no longer be limited to parameter improvements, but will emphasize enhancements in the consumer experience that are truly perceptible.

“Indoor and outdoor versatility” has become a non-negotiable basic requirement. Consumers want slippers that are portable, waterproof, non-slip, breathable, and have a soft and comfortable feel, allowing for a seamless transition from home to everyday outings.

In the North American market, slippers that emphasize foot support, cushioning structures, and anti-fatigue designs are more likely to achieve a 20%-40% price premium; while in the European market, functionality is often combined with material narratives, such as “lightweight but more durable” and “comfortable but more environmentally friendly.” This combination of “function + narrative” is becoming the most commercially valuable direction in slipper trends.

1.4 Material Transformation: From “Sustainable” to “Recycled Standards”

If “sustainable materials” were still a trend label in 2024–2025, by 2026, it will have become a basic requirement for the industry. The new focus of competition will be on “recycling and upgrading.”

More of the following are expected:

- Recyclable EVA materials: Further upgrades in lightweight and rebound performance;

- Environmentally friendly PVC with extremely low heavy metals and harmful residues: Meeting European and American regulations and supermarket access standards;

- Plant-based leather and bio-based pigments: Strengthening the brand’s environmental narrative capabilities.

For slipper wholesale buyers, material selection not only affects the cost structure but also directly determines whether the product is eligible to enter mainstream channels.

II. 2026–2027 European and American Market Bestseller Predictions

2.1 Retro Birkenstock-style Sandals with Recyclable EVA Soles

These products combine functional and design advantages. The lightweight and non-slip recyclable EVA sole, combined with a cork insole, provides stable support while significantly reducing walking fatigue. The upper supports free customization, suitable for creating brand differentiation.

Recommended Channels: Boutique shoe stores, department stores; a representative style of high-priced slipper trends.

2.2 Classic Multi-color Eco-friendly PVC Slippers

Winning with high cost-effectiveness and high customizability. Supports Pantone color card customization, and the upper and body blank areas can be customized with logos, suitable for large-scale distribution.

Recommended Channels: Supermarkets, mainstream shopping platforms; a stable volume seller in slipper wholesale.

2.3 Low-saturation Minimalist Flip-flops

By upgrading the sole material and refining details, comfort is significantly improved while maintaining lightness. Supports sole print customization, suitable for online brands to quickly test the market.

Recommended Channels: Fast fashion brands, independent websites.

2.4 Modular and Adjustable Slippers

The interchangeable parts design allows consumers to freely combine different uppers and soles, extending the product lifecycle and enhancing the interactive experience.

Recommended Channels: Boutiques, trendy concept stores; this is an experimental product for cutting-edge slipper trends.

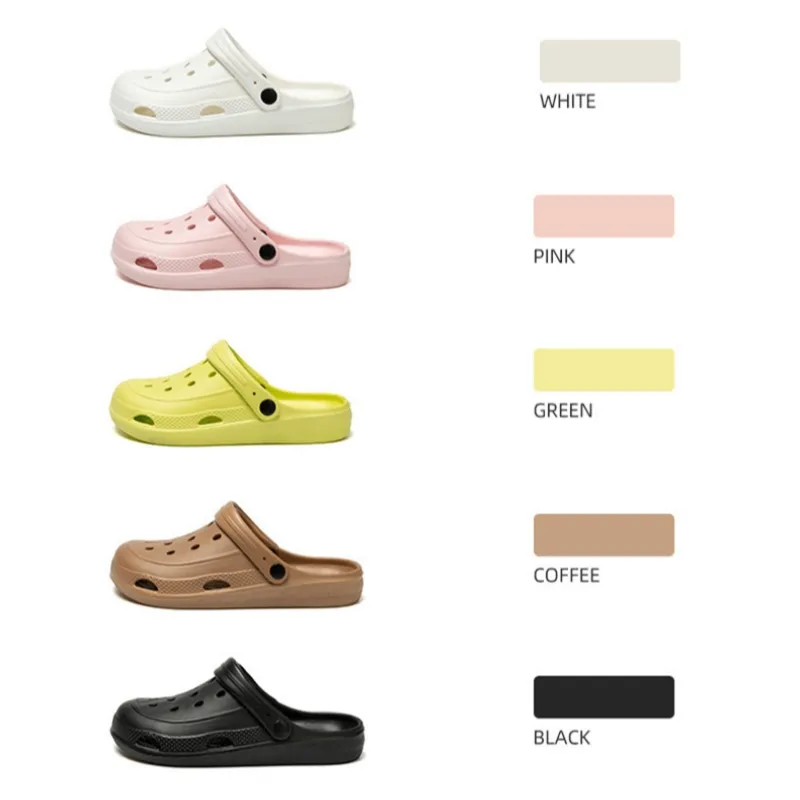

2.5 Clogs and Accessories

The popularity of clogs continues, but consumer demand for eco-friendly materials and diverse colors has significantly increased, making customized shoe accessories a new growth point.

Recommended Channels: Fast fashion, trendy retail.

III. Annual Action Guide for Wholesale Buyers (Q1–Q4)

Q1 (January–March): Supply Chain and Pricing Strategy

Complete the selection of suppliers for footwear made with renewable materials, prioritizing 3–5 factories that can provide authoritative environmental certifications (such as California Proposition 65, EU RoHS).

Offline supermarkets/department stores: Basic functional styles, 15%–20% markup;

Online DTC/boutiques: Design + functional styles, 40%–50% markup.

Q2 (April–June): Creating Test Bestsellers

Focus resources on developing 3 core styles (e.g., retro Birkenstocks, clogs, eco-friendly PVC slippers), and test market feedback through core channels.

Q3 (July–September): Data-Driven Inventory Management

Conduct a second round of inventory and slipper trend based on sales data, focusing on best-selling SKUs, and clearing out slow-moving items with discounts to optimize cash flow.

Q4 (Year-round): Review and Structural Optimization

Review sales performance quarterly, continuously adjust the SKU structure, and ensure the ability to iterate bestsellers and maintain healthy inventory levels.

Conclusion: Slipper Trends are not predictions, but proactive planning

The slipper market in 2026–2027 will be a stage of deep integration of function, design, and sustainability. For wholesale buyers, true competitiveness lies not in “following trends,” but in understanding slipper trends in advance and transforming them into actionable slipper wholesale strategies. Through precise product selection, reasonable pricing, and flexible inventory management, slippers can become a core category with both scale and profit.

About Mingyi

Jieyang Mingyi is a leading PVC/EVA slipper manufacturer in China, specializing in the research, development, production, and wholesale customization of slippers. We offer a complete product line covering PVC slippers, EVA slippers, Crocs shoes, flip-flops, sandals, slipper accessories (soles and uppers), and Crocs charms, meeting the needs of different markets and channels.

Mingyi supports multi-style, multi-color, and multi-functional customization, providing one-stop OEM/ODM services from design and prototyping to large-scale delivery, helping brands quickly respond to slipper trends and efficiently penetrate the global slipper wholesale market.

FAQ (Optional)

Q1: Will using environmentally friendly materials significantly increase costs?

Short-term costs may increase slightly, but this can be offset by premium pricing and channel access advantages in the European and American markets, and is more conducive to stable brand development in the long term.

Q2: Are trend-driven styles suitable for small-batch buyers?

They can start with modular or highly customizable styles to reduce inventory risk and simultaneously test market acceptance.

Q3: Which certifications are most crucial for the European and American markets?

California Proposition 65, RoHS, and material safety testing are basic requirements for entering mainstream channels.